Trump’s Updated Tariffs to Cost Households Thousands, Yale Study Finds

The Yale Budget Lab estimates that Trumps updated tariffs will cost the average household up to $4,400.

NEW HAVEN, C.T. — The Yale Budget Lab has released a new report detailing the sweeping economic and fiscal effects of the Trump administration’s 2025 tariff policies, projecting historic increases in consumer prices, a significant reduction in U.S. economic growth, and steep losses for American households — especially those with lower incomes.

The analysis, revised on April 9, comes in the wake of the administration’s latest move to adjust tariffs on a wide array of imports, with particularly aggressive rates targeting Chinese goods.

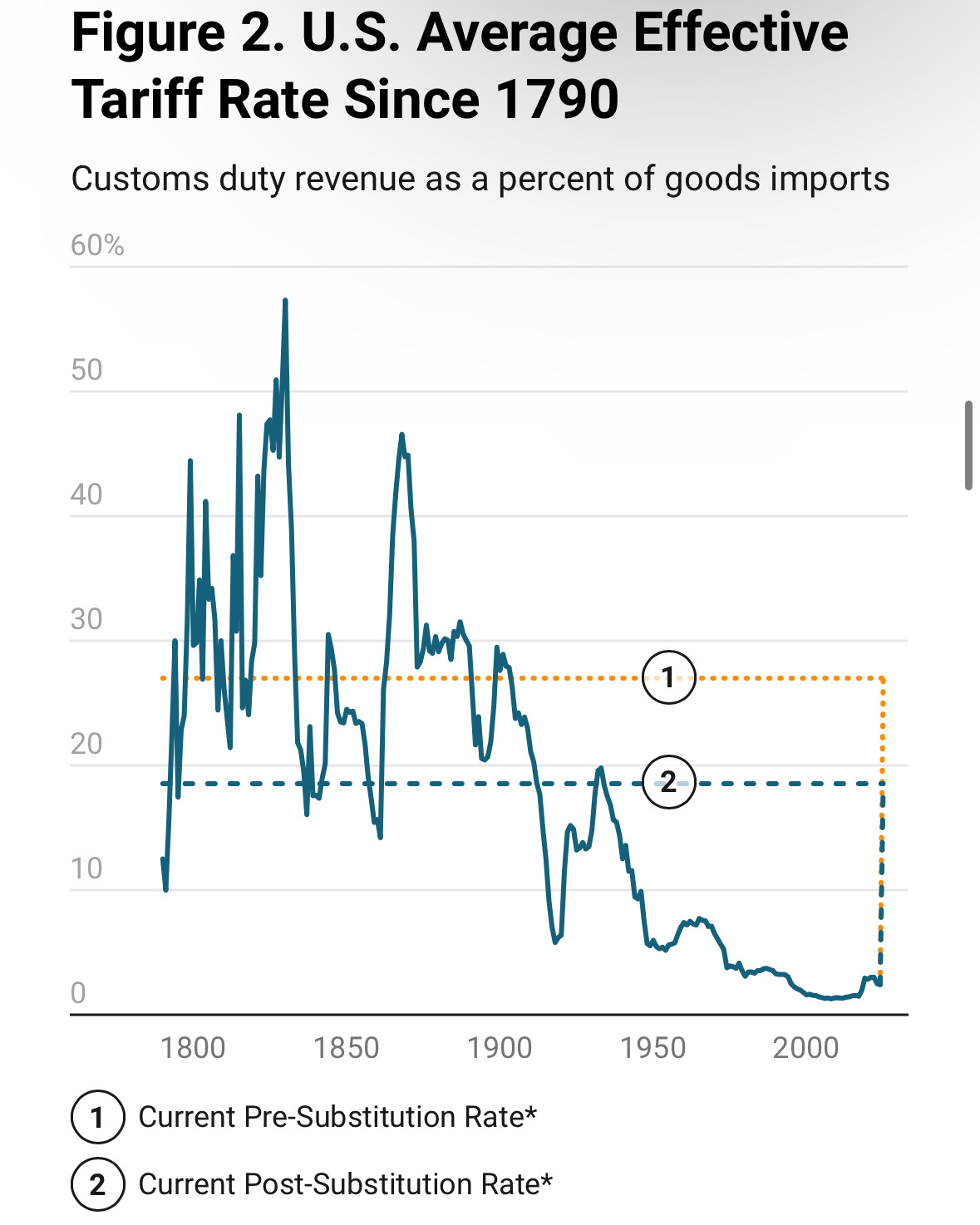

“Consumers face an overall average effective tariff rate of 27%, the highest since 1903,” the Budget Lab report states. Even after accounting for how consumers and businesses may shift away from more expensive imports over time, “the average tariff rate will be 18.5%, the highest since 1933.”

The report estimates that tariffs will raise consumer prices by 2.9% in the short run. For the average American household, that amounts to a loss of $4,700 in purchasing power based on 2024 dollars. Even after substitution toward less expensive goods and suppliers, prices are expected to remain 1.7% higher, or $2,700 per household.

Commodity prices are expected to spike unevenly, with some categories seeing staggering increases. “Consumers face high increases in clothing and textile prices in the short-run: prices increase 64% for apparel and 44% for textiles,” the report states. Even after the market adjusts, prices are projected to remain 27% and 17% higher, respectively.

Motor vehicle prices are also set to rise. “Motor vehicle prices rise 12% in the short-run and 19% in the long-run,” the report finds, which could add $9,000 to the cost of a new car by the time the full effects are felt.

Food prices will rise 2.6% in the short term and remain about 3% higher in the long term. Fresh produce prices alone are expected to increase by 5.4% initially and settle at 3.9%.

The Yale Budget Lab warns that the new tariffs function as a regressive tax, disproportionately impacting lower-income families. “The burden on the 2nd decile is 2.5x that of the top decile (-4.9% versus -2.0%),” the report states.

That translates to an annual loss of $2,100 for households in the second income decile and $10,000 for top decile households, though as a share of income, the impact is heavier on those with less.

“Tariffs reduce both labor income and above-normal returns to capital,” the report adds. In the short term, owners of capital may not feel the same immediate pain, but over time the burden becomes more broadly distributed.

A central feature of the revised policy is a staggering 125% tariff on Chinese goods, layered on top of a pre-existing 20% rate imposed under the International Emergency Economic Powers Act (IEEPA). This creates a maximum tariff rate of 145% on select Chinese imports.

“Measured pre-substitution — assuming there are no shifts in the import shares of different countries — the 2025 tariffs to date are the equivalent of a 24.6 percentage point increase in the US average effective tariff rate,” the report explains.

After substitution, when importers shift away from Chinese goods and toward alternative suppliers, the increase is smaller but still historic: a 16.1 percentage point rise in the effective rate.

The tariffs are also expected to take a heavy toll on the broader economy. The Yale Budget Lab projects that real GDP growth will fall by 1.1 percentage points in 2025. In the long term, the U.S. economy will be 0.6% smaller each year—amounting to $170 billion annually in lost output.

Job losses are also expected. “Payroll employment [will be] 740,000 lower” by the end of 2025, with the unemployment rate rising by 0.55 percentage points, the report says.

On paper, the tariffs are projected to raise $2.4 trillion over 2026–2035, but the overall fiscal benefits are diminished by reduced economic output, which is projected to reduce tax revenues by $587 billion.

Other countries have not gone unaffected. The report finds that Canada’s economy shrinks by 2.2%, largely due to both U.S. tariffs and retaliatory trade measures. China’s economy is expected to shrink by 0.6%, roughly the same as the United States. Meanwhile, the European Union and United Kingdom are projected to see slight long-run gains, of 0.1% and 0.2% respectively.

While a 90-day suspension was announced for certain tariffs (excluding those on China), the Budget Lab cautions that even a temporary pause does little to mitigate the long-term impact. The tariffs, it says, mark a sharp departure from historical U.S. trade policy and could have enduring consequences.

“The sheer size of the proposed tariff on China means that the distinction between pre-substitution and post-substitution is a crucial one,” the Budget Lab warns, underscoring the complex ripple effects these policies will have on the global supply chain, domestic industries and household budgets alike.